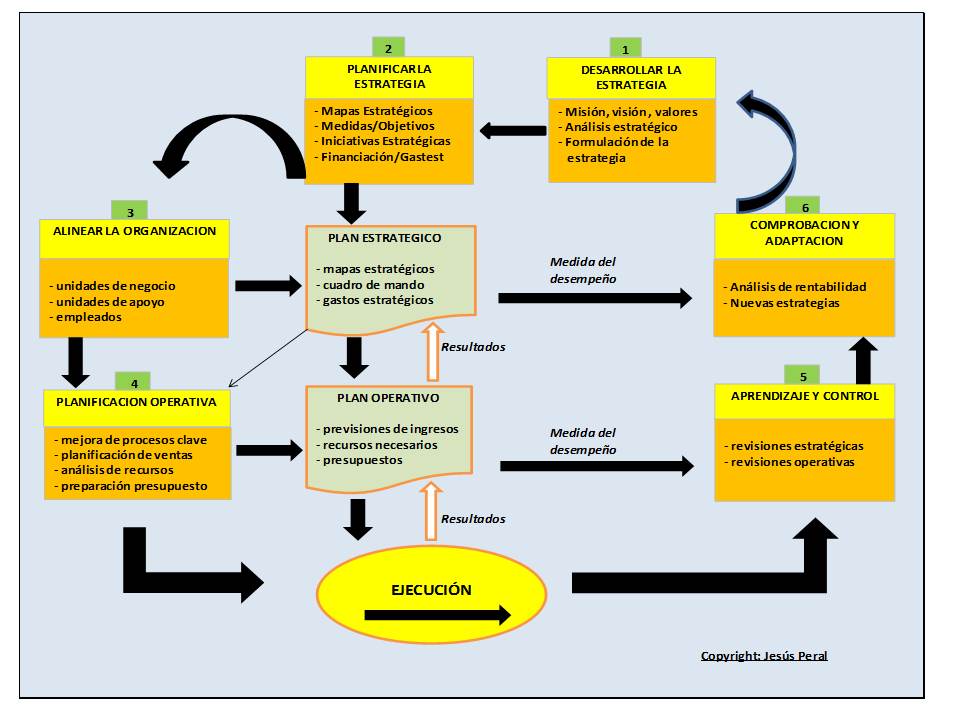

If we asked successful CEOs about the meaning

of organizational effectiveness we would find different definitions but the most

accurate one will be found inside the company and in the way it manages the

current business environment.

Nowadays, apart from having a good business

plan, all companies require an effective and efficient plan describing any

single aspect the company has to take into account to achieve the

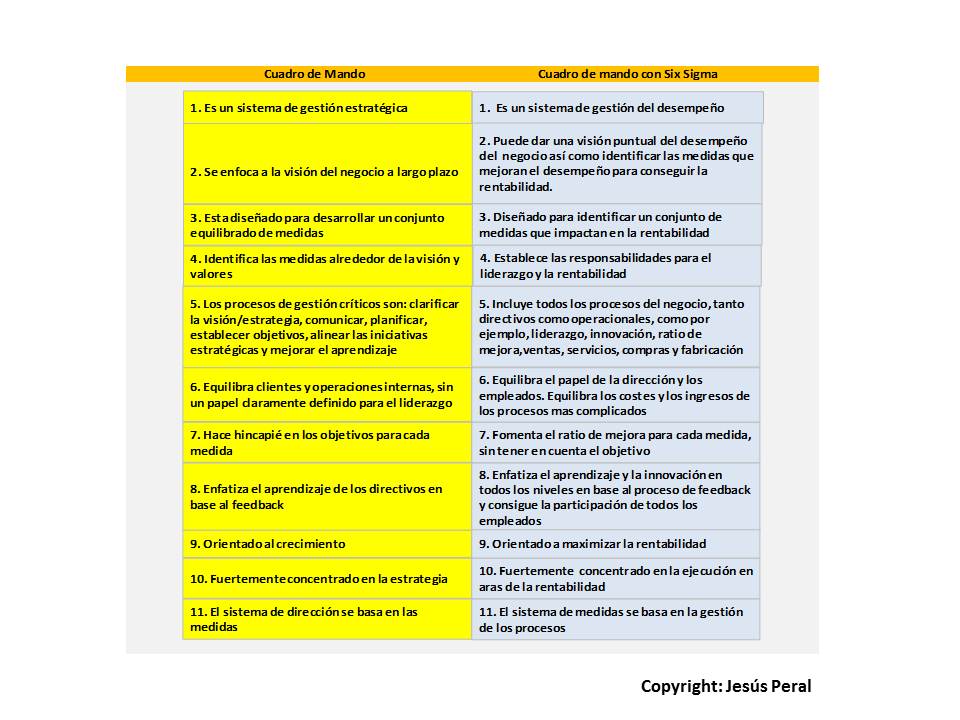

organizational effectiveness. The project should be clear and should allow the

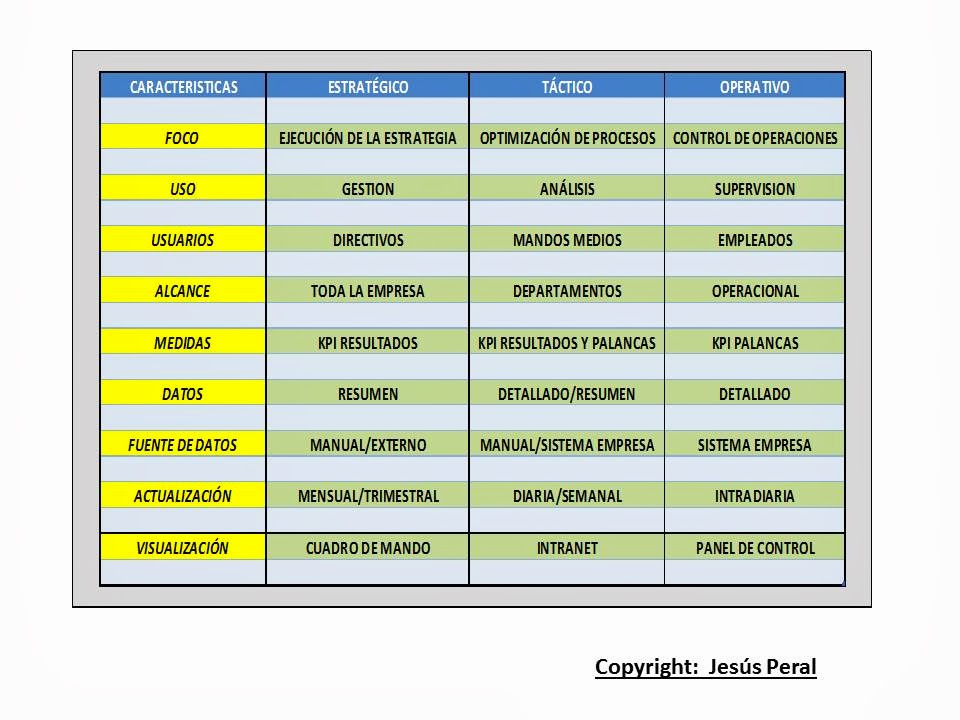

assessment of the performance by comparing the KPIs most applicable to the

organization.

The senior management leadership will allow the

execution of both plans. The management style should flow top-down fostering a

results-oriented organizational culture and the development to the execution

capacity.

To know if the company has achieved the

organizational effectiveness we must monitor if the current results are

relevant for creating value and are coherent with the vision.

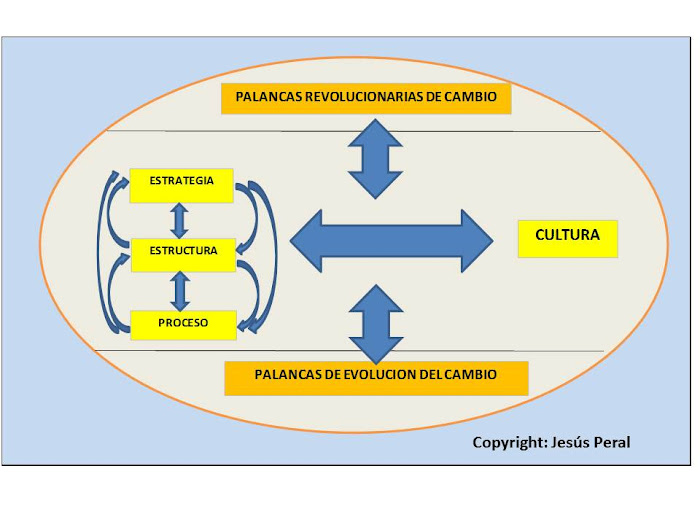

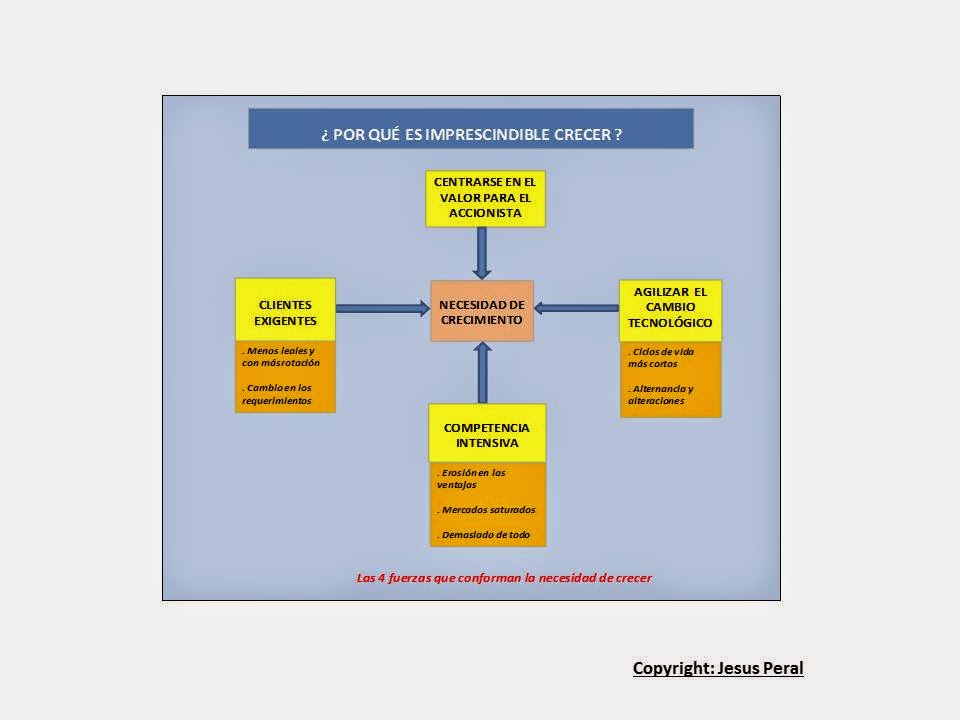

In the current economic environment all changes

are very rapid which proves the responsiveness, utilization and adaptation to

the emerging opportunities. With this regard, by knowing how to measure and

adjust the action plan based on the perceived value for all the stakeholders is

evident that the company will learn, as the vast majority of employees will be

receptors and actors of the change that is required.

In my opinion this is the only way to manage

the transformation, which is the result to achieve the organizational

effectiveness. The organizational effectiveness is a direct result of the

interaction of processes, system, risks, structure, culture, people, etc in a

way the company is developed by putting in action some critical elements as

follows:

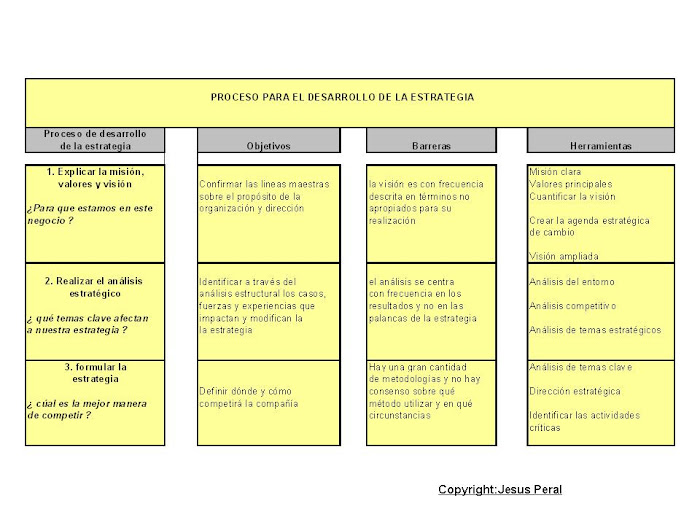

·

The

dynamic nature of short and long term objectives outlined in the strategic

process

·

The

focus on the customer

·

The

alignment of goals, objectives, incentives, and people

·

The

leadership of senior management impacting the results

·

The

alignment of the talent to the critical positions to have the right people in

the right roles

·

The

assessment of the performance at all levels

·

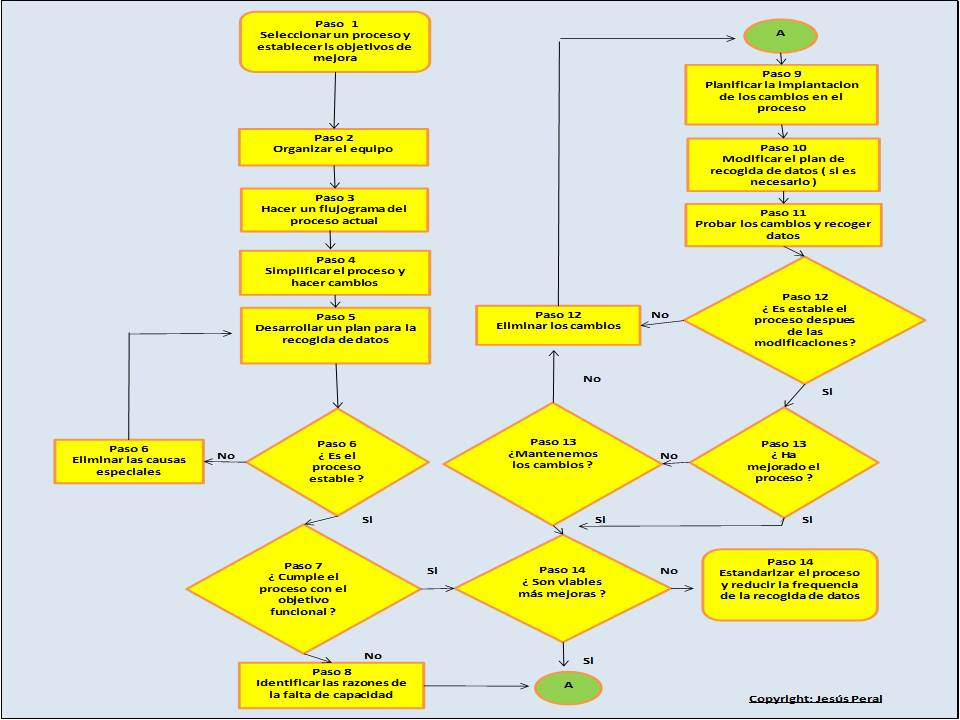

Identify

potential improvements and carry out those improvements

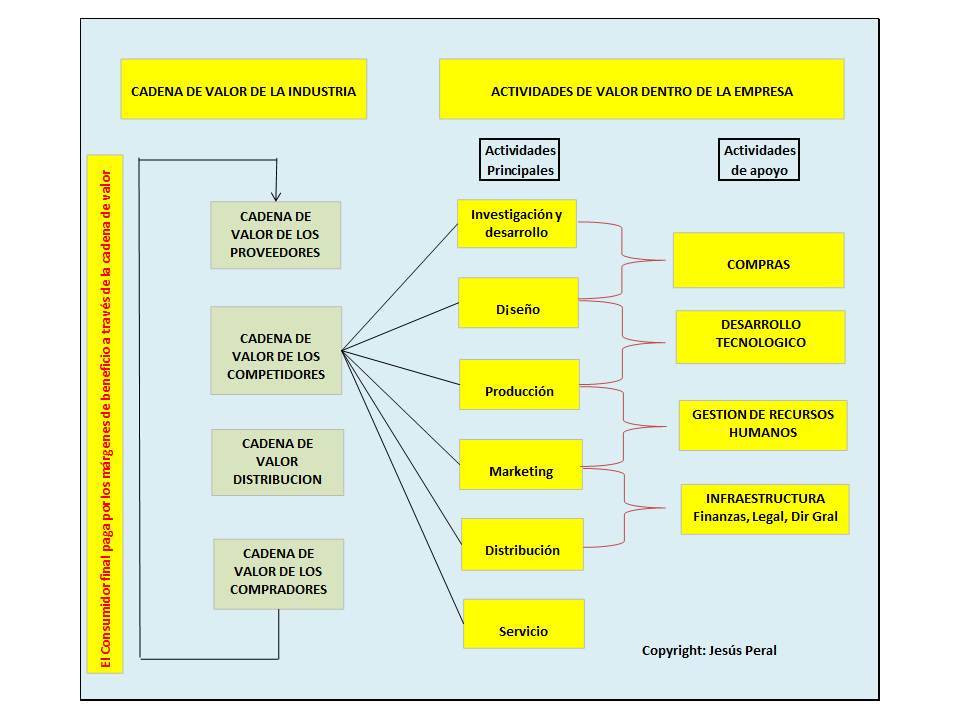

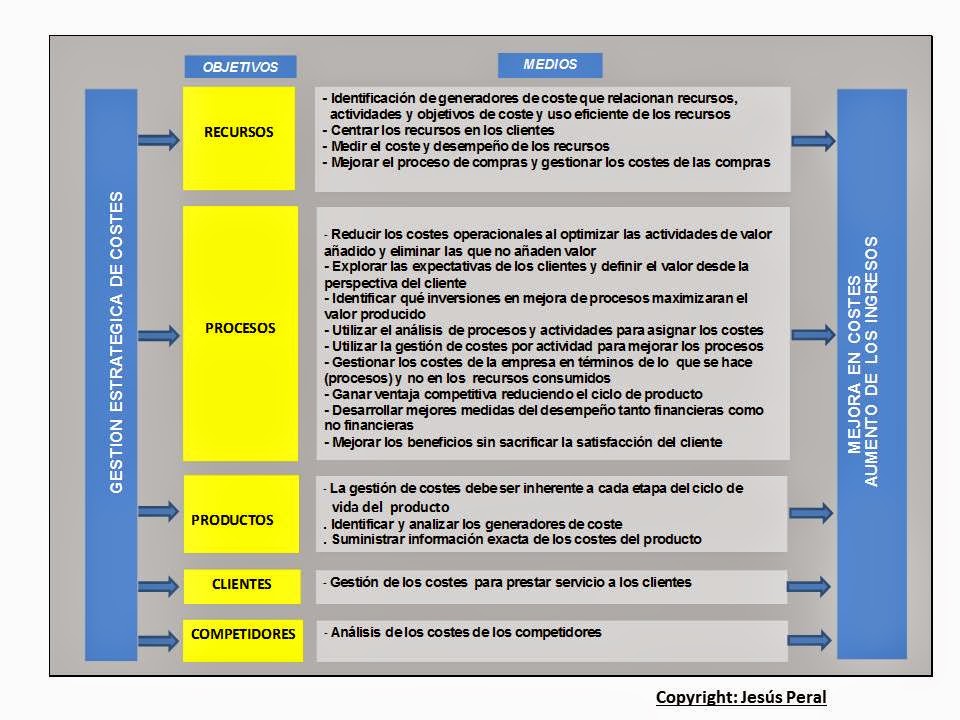

The action plan should include the intelligent

management of all risks, innovation, take advantage of the big data, problem

solving scenarios, continuous improvement and the adaptation of the activities

leading to the strategic goal, as this is the only way to be better than the

competitors in the market place and in

addition to achieve a superior performance.

The action of all the above elements implies a

strong commitment from senior executives and other management levels to make

things happen in the right moment and with the available talent. Just to

remember an organization is simply a group of people, the human capital, so

each person can contribute to the effectiveness by developing the talent and

skills.

If the organization has capable and committed

employees those employees should lead the more important activities so less

capable employees are challenged and therefore prompted to leave their comfort

zone creating a culture focused on accomplishment, results and rewards Needles

s to say that the satisfaction at work, the motivation and the commitment have

to be protected to shape the ideal organizational culture in a healthy manner.

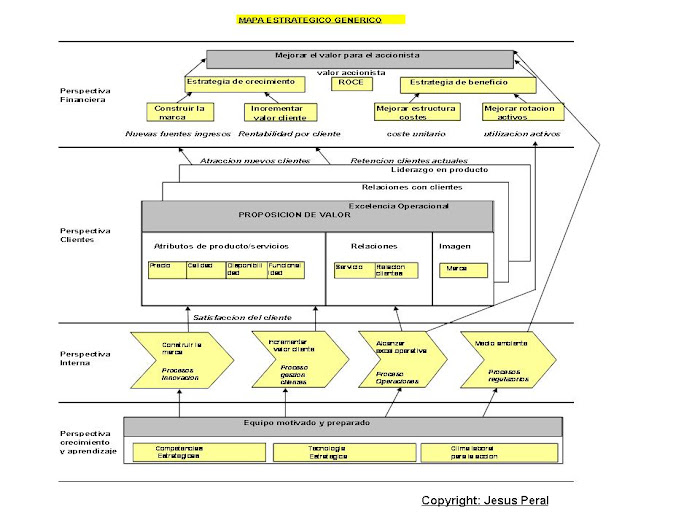

Finally, just to indicate, that organizational

effectiveness is simply the harmonic relationship between focus, alignment and

results in all the functions which leads the organization to work successfully

as a whole bringing the organization close to its vision.