Sometimes we

are very busy fire-fighting and troubleshooting and therefore we have no time

to analyze how the business is performing both operationally and financially.

In this post

I would like to share my simple and short model to cope with the above

mentioned situation. Obviously you don’t need to follow all. There are no fixed

rules, just use common sense and check how the movements in both Balance Sheet

and P&L are related.

First of all

we need to minimize the effort: concentrate in “big numbers”. Use just a few

ratios and only those you really understand the meaning. Look at the evolution

and compare them with the competitors.

I will start

for the analysis of the business as follows:

Sales/Commercial management and market

·

What do we sell ? What is our level

of revenue? Did we have sales growth ? which is the impact in our operating

needs of funds ?

·

Are our sales seasonal ? Check

operational risk

·

To which customers do we sell? Big customers,

small customers, many, few, etc. Check reliability and strength of those

customers.

·

Competitors ? many ? strong? Focused

on price ? on quality ?

Production management/Vendors

·

How is the production? Uniform or

seasonal? Based on orders?

·

Production process: long or short?

Check impact in inventory

·

Which the importance of the vendors ?

many or just a few? Are the vendors stronger than us?

Senior Management/strategy

·

Is the senior management doing

well? We need to understand the impact

of potential problems in the management decisions in a particular period in our

balance sheet and profit and loss account. For example, what will be the impact

in our balance sheet if the sales are seasonal? And if the production process

is long? Or if we experience a decrease in our sales.

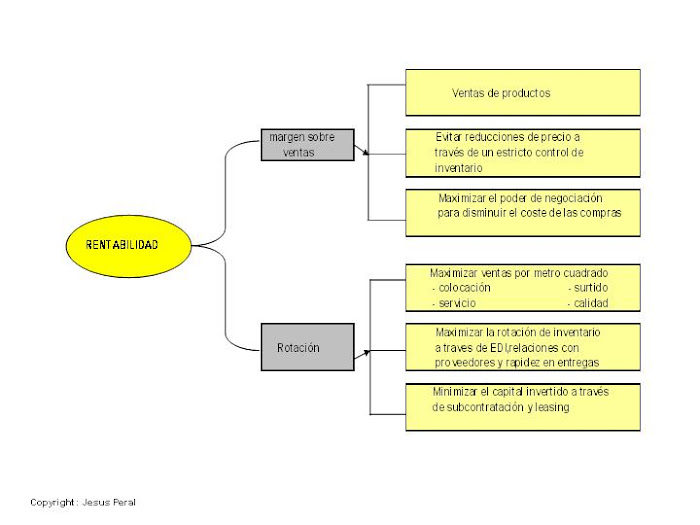

Now it´s time

to look at the profit and loss account

to review profitability

·

Sales. Growth, seasonality, variability

·

Key figures in the P&L. “Big

numbers” which is critical? Check how the Margin, EBITDA, return on sales have

changed as percentage of sales. Compare with main competitors.

·

Financial expenses, simple ratio

EBIT/Interest charge

·

Did we have profit? Check ratios,

return on equity, return on assets and analyze the size of the profit.

·

Risks: which is the change in profit

when key figures are not doing well?

Balance sheet analysis/Financial situation

·

Big numbers in balance sheet. If our

business is seasonal we need to identify the key periods, for example, the

period with maximum cash and with maximum accounts receivable balances.

·

Identify the “big numbers“ in the balance

sheet. It is likely you will find the problem, if any, here. We can do a short

balance sheet. Assets: operating needs of funds + Fixed assets. Liabilities:

debt + Equity

·

What has happened? We can use our

cash flow statement. We can compare the period with one considered very good

for the business. Just concentrate in the relevant differences as here we will

have the problems. So now we need to know why. We need to review the

operational ratios.

·

We need to analyze the evolution of

our operating needs of funds and the working capital. Maximum and minimum

periods, for example. If we are shortage of cash this is due to the increase in

our operational needs of funds or that our working capital has decreased. There

is no other possibility.

·

If we increase our operating needs of

funds the reason is we are collecting worse, we have more inventories, we pay

quicker or we are growing too much, sales are lower, etc. We need to do a root

cause analysis by using the operating ratios.

·

If working capital decreased it could

be because our net equity is lower, due to dividends paid or losses, also it

could be that our long debt is down or an increase in our fixed assets.

·

It is important to review potential

risks in the balance sheet and the evolution of the operating ratios in

comparison with the industry. The operating ratios evolution impacts our cash

conversion cycle.

Finally

we should perform a quick review of the value chain which is associated to how

we build our return on equity. This ROE is our margin x turnover x leverage. If

we simplify the calculation of these 3 components we will end up the ROE is net

profit/net equity. The action here is how to increase ROE. Normally there are 3

things to do:

·

Increase ROS ( return on sales) by

increasing margins or reducing operating expenses

·

Increase turnover, by selling more

using the same level of assets or selling the same using less assets so being

more efficient.

·

Increase leverage, using less equity

and more debt or the so-called spontaneous financing.