In this post I would like to share, in all

modesty, my experience in one of the critical

activities the finance department is in charge: budgeting/forecasting.

Although the vast majority of the finance

community is aware or has experienced similar situations or methodology I think

it is worth to give some personal insight.

Let´s start from the typical question: Do we

need budgets? The normal reply is we do, of course.

Budgets don´t win friends but they influence

people. They can be painful to create and agonizing to manage. But they

translate policy into financial terms and whether like it or not that is the

way in which plans should be expressed and ultimately, performance controlled.

So in my view I can indicate three reasons for

the need of budgets:

·

To

show the financial implications of the plans

·

To

define the resources required to achieve the plans

·

To

provide a means of measuring, monitoring and controlling the results against

the plans.

However there are also problems. The typical

problems you face could be as follows:

·

An

inadequate basic budgeting procedure. For example, imprecise guidelines,

unsatisfactory background data, cumbersome systems, lack of technical advice

and assistance to managers and of course, the typical arbitrary cuts by top

management. Does this sound familiar to you?

·

Lack

of accurate forecasts of future activity levels. Very critical in my

experience.

·

Difficulty

in amending the budget in response to changing circumstances.

·

The

fundamental weakness of basing budgets on past levels of expenditure which are

simply added up rather than subjecting the whole of the budget to a critical

examination.

·

Weakness

in reporting or controlling procedures which prevent the budget being used to

monitor performance.

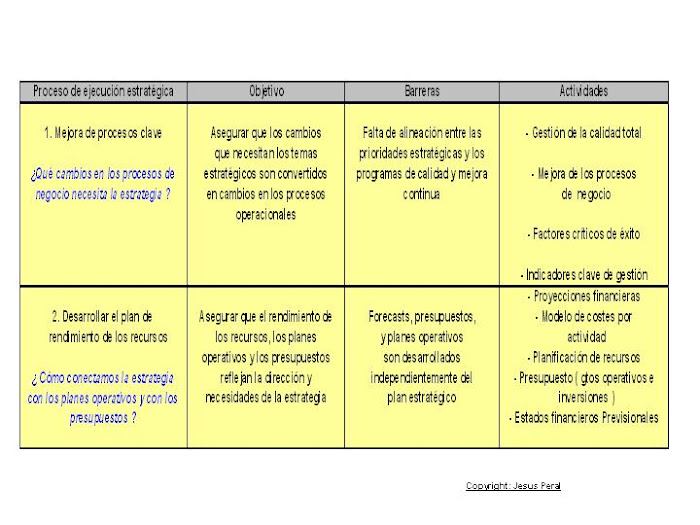

You could reduce the above mentioned problems

when preparing the budget by using some methodology and discipline in the

process, for example:

·

Prepare

budget guidelines which set out policies on where you want to go and how you

want to get there. For example, this could be expressed in targets, for sales

production or activity levels, and as an outline of the major marketing and

production plans. In addition, the assumptions to be used in budgeting should

be given. This could include rates of inflation or increases in the costs and

prices.

·

Ensure

that those responsible for preparing the budgets are given advice and

encouragement by the correspondent managers. These “experts” should be there to

help, not to blame or threaten!!

·

Get

people to think hard about their budgets. For example, they should not be

allowed just to update the last year´s result actuals. Very typical right??

Wherever there is any choice on how much is spent they should be asked to go

back to first principles and justify what they are doing. This is a base for

the so called zero base budgeting that I will comment briefly at the end.

·

Do

not accept any significant increase or even decrease from last year´s budget

without an explanation.

·

Probe

to ensure that budgets submitted are realistic and do not include the typical

“cushions”. If you need this, discuss it in advance to get agreement.

·

If

you are in charge to approve or review the budget do not cut arbitrarily.

Give reasons. If you don´t you will foster, the “cushion factor” or the typical

“could not care less attitude.

·

Finally,

update or “flex” budgets regularly especially when activity levels and costs

are subject to large variations.

Flexible budgets are a good tool. If it is

possible, with a reasonable degree of accuracy, to relate the changes in the

revenues and costs to levels of activity, the use of flexible budgets is

worthwhile. Budgets are, let´s say, “flexed” by recalculating revenues and

costs which vary with activity levels by reference to actual levels so giving

an expected level of revenues and costs. The difference between the original

and expected levels is normally referred as the activity variance and the

difference between expected levels and actual levels is normally referred as

the controllable variance. It is on the latter figure where we should

concentrate if you want a realistic picture of how costs are performing. There

is also the possibility to review the budget periodically during the year to

meet changing conditions. Here you will use the well-known rolling

budget/forecast and although, in my opinion, it is not as effective as the

fully flexible system, it is easier to operate.

The final piece is the budgetary control. A

budgetary control procedure is not easy to achieve. You have to work at it and

create it based on your needs and goals. There is no problem in designing a

system with “elegant” forms and lots of information. The difficulty is in

maintaining the scheme as a useful instrument once it has been set up. The encouragement

can only come from the top. The CEO/CFO should insist on a rigorous approach to

building budgets and a reporting procedure which is used to make things happen

the way they want them to happen. And they have to ensure that everyone

concerned knows what is expected and is accountable for any failure to perform.

To conclude, some comments on zero-base

budgeting. The traditional approach to budgeting tends to perpetuate the

commitments of previous years. For example, past levels of expenditure are used

as a base from which to project increases or decreases. Only part of the budget

is analyzed and normally, the managers concentrate on justifying increases

rather than challenging the need for any function or activity in its present

form. The priority based budgeting (zero base) requires managers involved in

budgeting to re-evaluate all their activities in order to establish their

relative priority and decide whether they should be eliminated or funded at a

reduced, similar or increased level.

Zero base budgeting is not the panacea and it

has often failed because companies have introduced overelaborate procedures

which have sunk almost without trace in a sea of paperwork. So here the

emphasis, in my experience, should be on the value in getting priorities right

and ensuring that costs and benefits are thoroughly reviewed to the advantage

of all concerned.

It is likely some of the readers are currently

in their annual budget exercise so Happy budgeting!!!

No hay comentarios:

Publicar un comentario