Business and managers don’t earn profits they earn money. Profit is an

abstraction from the true, underlying movement of cash in and cash out. It

could be argued that profit is the result not the objective of an efficient

management.

On its own, as shown in a balance sheet, is not necessarily an accurate

measure of the success of a business. Profit figures are normally influenced by

factors quite distinct from the trading performance of a company. These for

example could include how research and development is treated in the accounts,

how stocks and work in progress are valued and how the flow of funds resulting

from investments and realization of investments are considered.

If we simplify, all you have to do in business is to make some stuff and

sell it to someone else for more than you paid for it. Indeed we are in

business to make money. Money earned with ethic, integrity and focused on the

social responsibility.

Profit improvement is about increasing the flow of money into the

business and reducing the flow of money out. It is not about maximizing an

abstraction called “profit” subject to many different influences.

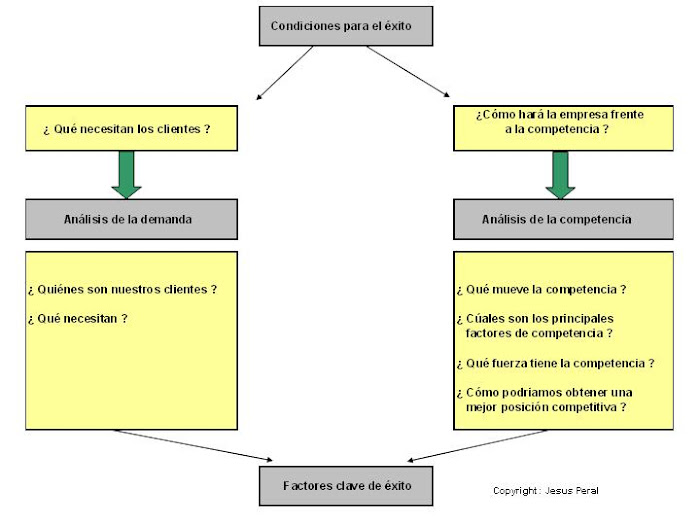

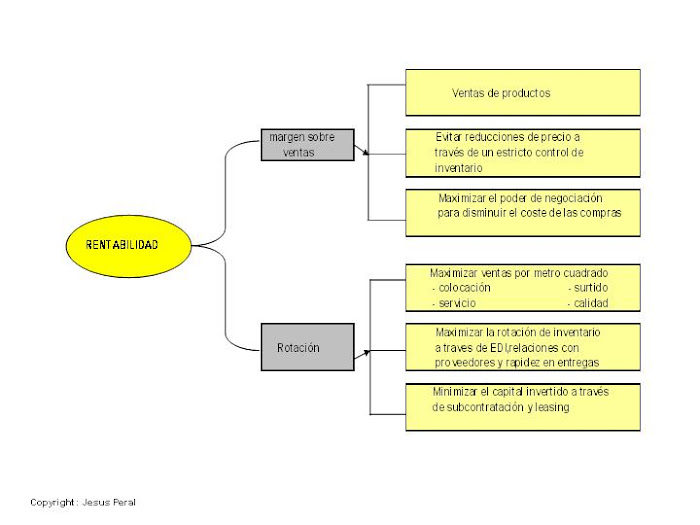

So, the question is, which are the most important factors affecting

profit improvement? Experts working on managerial roles know very well: sales, costs and effectiveness.

The maximization of sales revenue

depends first on good marketing. There are two approaches to marketing. One

is to assess the market in terms of what existing and potential customers will

buy. This means an analysis of the existing wants and buying patterns along

with possible future needs. The other is to assess the scope for creating wants

which does not exists at the moment, by developing, for example, new product or

services. Good marketing also ensures that prices match what customers can be

persuaded to pay with the objective of maximizing contribution to profits and

direct overheads. Maximizing profit means getting the right balance between

high margins and high sales volume.

The second factor is the cost.

Cost, after all, does not exist by itself. It is always incurred. What

matters therefore is not the absolute cost level but the rates between efforts

and their results.

The approach to cost reduction should therefore be to distinguish

between those which are producing results and those which are not.

Indiscriminate focus and attack to all costs might be counter-productive. On a

selective basis it may be better to cut something out in one go and not series

of marginal cost reductions. Why trying to do something cheaply if actually it

should not be done at all.

On the third factor just to say the objective should be effectiveness

rather than just efficiency. To do the

right things rather than merely to do things right. This is something which

is well-known.

But what would be the areas to be focused on? On my view, as follows:

· Productivity- getting more for less, for example, return

on investment, or manpower, output per head.

·

Finance- tightening credit policies, cracking down bad

debts, controlling quantity and settlement discounts, optimizing cash holdings

etc. But most importantly the management team has to work as a real team in all

finance areas that might affect the business before taking any decisión.

·

Inventory, very typical- keeping the amount tied up in

working capital to the minimum consistent with the need to satisfy customer

demand.

·

Buying-ensuring competitive bids are obtained for all

new or renew contracts, specifying to buyers how they should do to get good

terms, resisting the temptation to over-order and having clearly laid down

policies on mark-ups.

Profit improvement should be a continuous exercise. It should not be

left until crisis forces you to think about it. Start with an analysis of your

current situation by doing a typical checklist. Look at the whole product range

for each market and assess the relative profitability and potential of all

products and markets. Use, for example, 80/20 rule to suggest the 20 percent of

your product/markets which generate 80 percent of your profits. Concentrate on

maximizing the effectiveness of the 20 percent of areas where the impact will

be greatest.

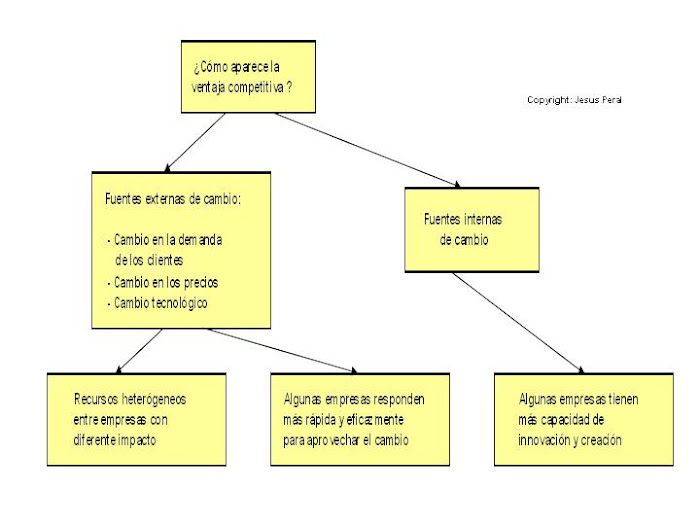

Identify those factors within the business which are restraining its

potential and, very well-know as well, convert

into opportunity what everybody considers dangers. So build on strengths rather

than weaknesses. Then look ahead.

Project trends, anticipate problems and, where needed, innovate so that your

company can challenge the future rather than being overwhelmed by it.

Your checklist should include:

·

corporate

analysis

·

strategic

plans

·

marketing

·

product

mix and development

·

sales

·

distribution

·

production

·

buying

·

inventory

·

productivity

·

people

·

finance

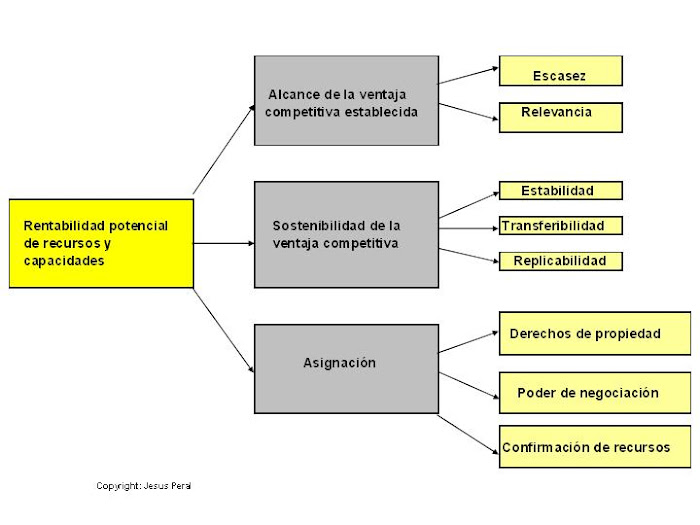

Finally remember, the best business survivors are, (honestly I don’t

think this view will be changed in the near future), first, those which can

deliver their products at the lowest cost and/or second, those which have the

highest differentiated position therefore having the product which the

customers perceive most clearly as being different from the competition to satisfy

their needs.

.

No hay comentarios:

Publicar un comentario