Sometimes when a CFO takes charge of the

finance department he/she is facing the boring task of being a simple tool for

the company placed aside of the business and even to be considered the

necessary bureaucracy to be run in parallel to the core business.

Although the above-mentioned scenario is

changing very rapidly nowadays it is on the hands of the finance community to

do a radical change and show that our department is really a profit center

supporting the business potential.

In this post I intent to share some ideas which

I consider are critical to cope with the so-called finance transformation.

Let me start with a simple statement: which is more important “earn money” or “have

money “? Have money, no doubt.

We, as finance experts, know that earn money

does not necessarily means we have money in the company. And when we decide to

have it, we aim not to have money in excess (idle money) but having the minimum

to run operations and get some additional debt capacity.

Within this process one of the most important

goals would be to improve the image perceived from third parties about our

performance to gain credibility. This would include our relationships with

customers, suppliers, communication with internal customers, financial

institutions etc.

A second goal is clearly to manage and reduce

the finance charges and expenses. Here it is important to increase our

negotiation power in front of our sources of funds, typically banks and other

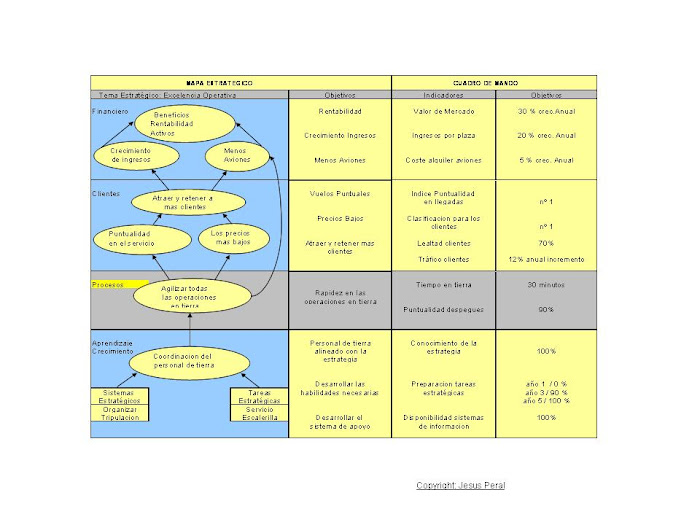

financial institutions. Create a balanced scorecard showing clearly our targets

and measuring the deviations and achievements would be really helpful.

In terms of reducing administrative costs it is

important to standardize and automate where possible finding areas of continuous

improvements and being focused on what actually matters to support business and

add value to the organization.

The finance team has to be motivated and proud

to belong to this function. We need to foster mentoring and coaching and allow

the reconciliation between our personal and professional life.

One aspect which normally is not taken into

account is to determine our internal customer and how we need to manage our

relationships. This is an important element for creating value. For example, we

could help the sales function by offering alternatives to gain share of

business in external customers. In other cases we can provide a quick valuation

of the feasibility of a particular capital investment project. Receive a

periodical feedback of our performance from our internal customers will allow us

to find areas of improvement. Innovation is also a magical tool.

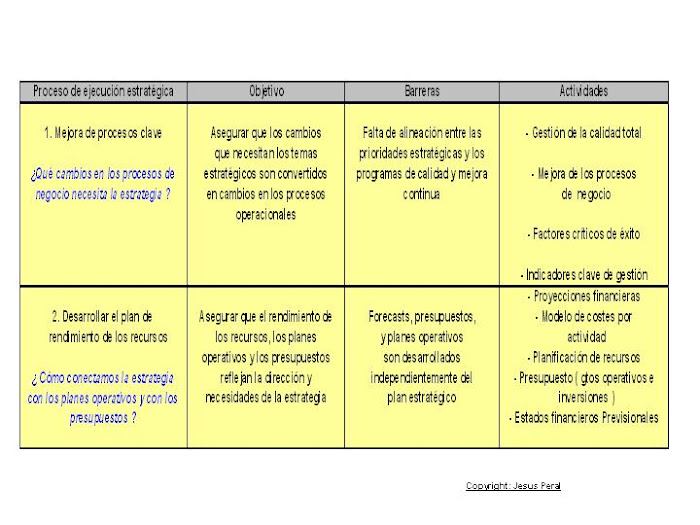

Too often, finance transformation initiatives

either focus on creating efficiencies, for example, to reduce costs and remove

non-core activities, or becoming more effective, for example, delivering more

insightful analytics or providing better business intelligence. In my opinion,

the effective and efficient are not mutually exclusive strategies.

Finally I would like to stress that

transformation objectives have to be designed to achieve both efficient and

effective results. While some initiatives will be focused on effectiveness

and others towards efficiency both

should be balanced in order for the global finance function to be properly

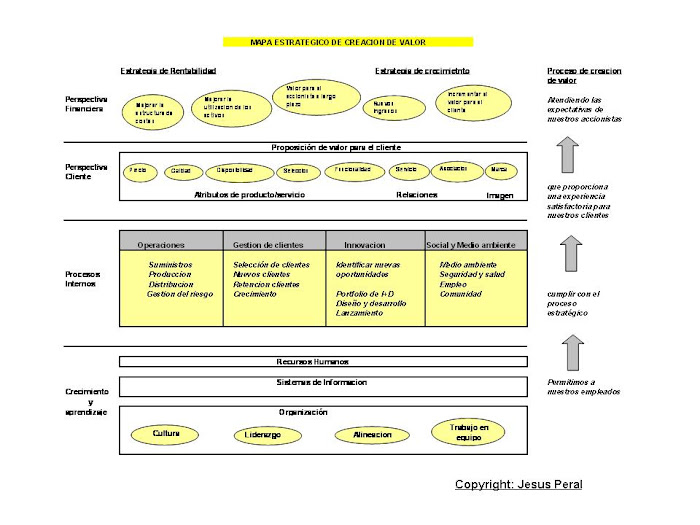

transformed and with the aim of the value creation. Many of the current

successful transformation strategies focus on increasing the overall

effectiveness of the finance function reducing simultaneously costs and

complexity. But these efficiency driven objectives are often posed by reducing

the headcount, which is an error in my honest view. To the contrary this should

be balanced against the potential value creation opportunities that could be

generated by those people, for example, managing better the processes and

volume of data in the reporting periods and changing the focus from data

gathering to the analysis of information.

No hay comentarios:

Publicar un comentario